PAKISTANSTARTUP FUND

Introduction

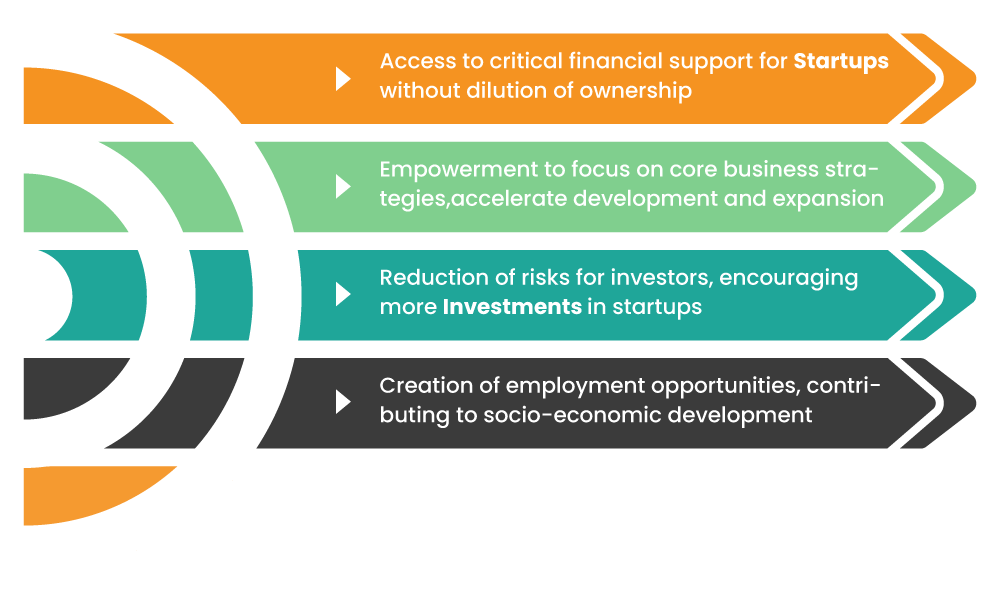

Pakistan Startup Fund is a government-backed initiative aimed at supporting and promoting the growth of startups in Pakistan through encouraging investments in Pakistan by the top-notch global as well as local VC funds. The Pakistan Startup Fund is designed to be a well-structured and comprehensive initiative aimed at fostering startup growth and innovation within the country.

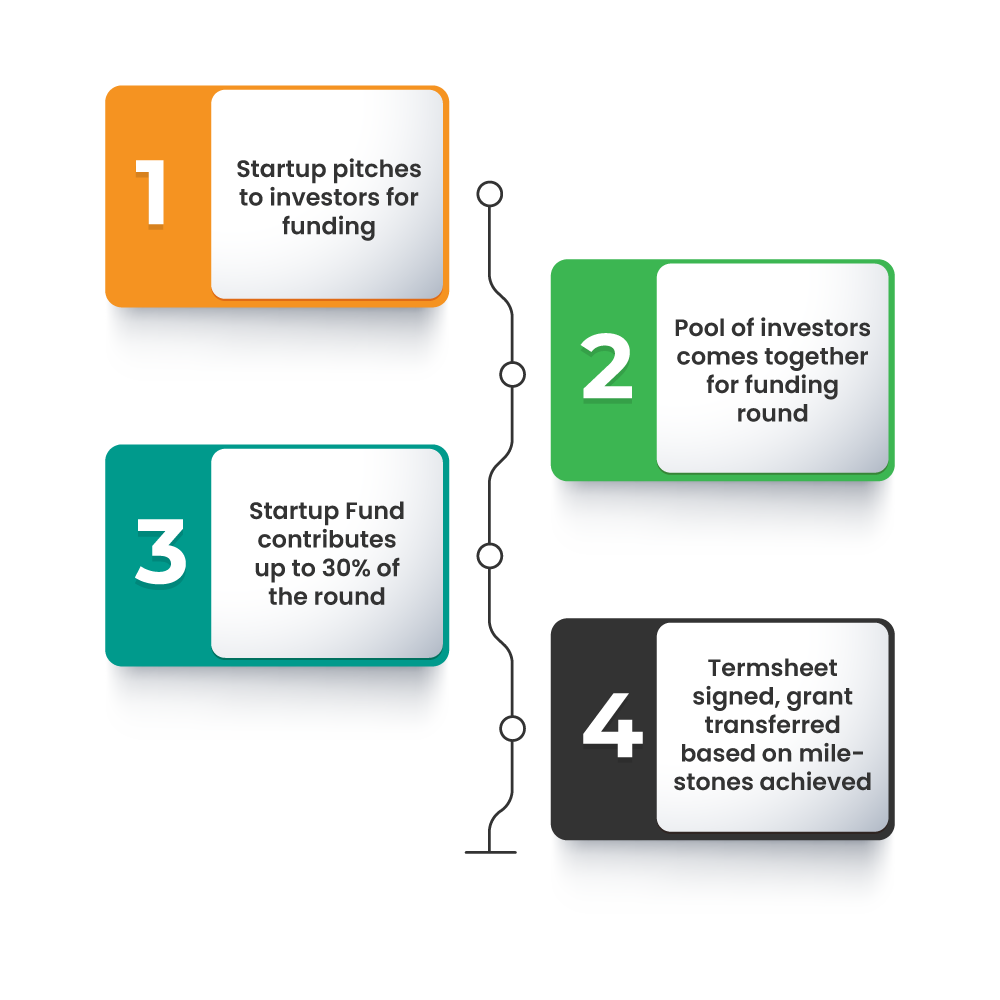

At its core, the Pakistan Startup Fund is a strategic partner in the success of startups. By contributing towards fulfilling the financial requirements of these ventures, the fund facilitates their growth and development. This support serves as the final piece of the puzzle (last cheque) in the initial round of funding, bestowed after venture capitalists have conducted their due diligence.

The grant from the Pakistan Startup Fund will only be disbursed to the eligible startup as the ‘last cheque’ in the ongoing funding round. This means that the startup must secure the full investment from the investor or VC before receiving the fund’s grant. The grant is positioned as the final piece of the financial puzzle, providing startups with additional support after they have secured funding from the private sector.

Fund Mechanics

⦁ Registration: A VC interested in availing PSF’s facilities will get registered as a PSF partner/member on the designated portal ‘startupconnect.pk’ ( https://startupconnect.pk/ ).

⦁ Whitelisting: PSF will carry out the due diligence and add the VC to its verified list of partners.

⦁ Application: VC funds will apply to the Pakistan Startup Fund for the grant against the investment in a Pakistani startup. Due diligence on the viability of investment in the startup will be undertaken by the VC, while the Pakistan Startup Fund will form an Investment Committee to devise a grant approval mechanism to pick which of the grant applications will be accepted.

⦁ Grant Disbursement: PSF will disburse the funds pro-rata to the tranche of the investment released by the VC.

⦁ Investment Range: The fund will offer 10%-30% of the total investment made by a VC in a particular funding round as equity-free capital or a grant as the last cheque.

The VCs will be entirely responsible for vetting a startup, gauging its potential, and making the best deals. The private risk capital investment ensures the success of the startup and thus good use of the capital. PSF will act as an investment partner without claiming any equity or royalty, taking any board position, or governance role in managing the startups, thus discarding any probable concern regarding the government’s involvement in the process.

Application

If you are a VC investing in Pakistani Startups, Apply now and become a partner of PSF